Fixed Deposits in India have always been one of the most trusted investment options, especially for those who prefer low-risk and guaranteed returns. Among these, Post Office Fixed Deposits (FDs) stand out as a secure and government-backed option, making them ideal for conservative investors. With the Post Office FD 2025 Calculator, individuals can easily estimate their returns on investments ranging from ₹10,000 to ₹1 lakh, helping them plan their finances efficiently.

What is a Post Office Fixed Deposit?

A Post Office Fixed Deposit is a savings instrument offered by India Post that allows investors to deposit a lump sum amount for a fixed tenure. The main attraction of a Post Office FD is its guaranteed interest, backed by the Government of India. Unlike market-linked investments, Post Office FDs provide certainty of returns, making them ideal for individuals who prioritize safety and stable growth of their money.

Key Features of Post Office FD

The Post Office FD offers multiple features that make it an appealing choice for investors. It is accessible to Indian residents, including minors through a guardian. The minimum deposit amount is ₹1,000, making it feasible for small investors, while the maximum deposit limit goes up to ₹15 lakh for a single account. The tenure can range from one to five years, and the interest rate is fixed for the entire term. The Post Office also revises interest rates periodically to align with market trends and inflation, ensuring that investors receive competitive returns.

Using the Post Office FD 2025 Calculator

The FD 2025 Calculator is a simple and efficient tool that helps investors estimate the returns on their investment. By entering the deposit amount, tenure, and interest rate, the calculator instantly provides the maturity amount and the total interest earned. For example, a ₹50,000 deposit for three years at the prevailing FD rate can be calculated in seconds, allowing investors to plan their finances without complex manual calculations. This tool is especially useful for retirees, salaried individuals, and those planning short-term savings goals.

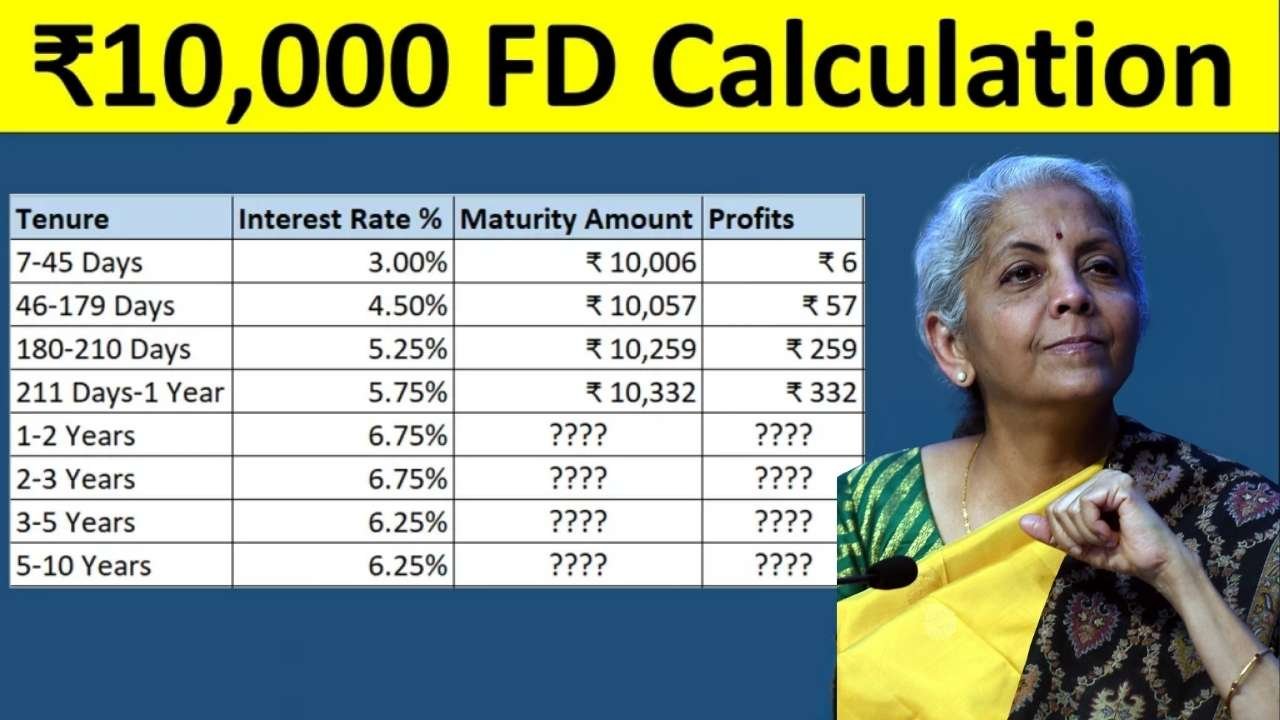

Interest Rates and Maturity Benefits

The interest rate for Post Office FDs is reviewed quarterly by the government to remain attractive to investors. Typically, the rates for one-year deposits are slightly lower than longer-term deposits, with five-year FDs offering the highest returns. The interest can be compounded quarterly or paid out monthly, depending on the investor’s preference. For small investments like ₹10,000, the interest earned provides a modest but reliable addition to savings. For larger amounts like ₹1 lakh, the returns are significant enough to supplement other income sources or cover specific financial goals.

Taxation on Post Office FD Interest

Interest earned from Post Office FDs is fully taxable under the Income Tax Act. The post office may deduct tax at source if the interest exceeds a certain threshold. Although the principal deposit is not eligible for tax benefits, the security of the investment and predictable returns often outweigh the tax implications. Investors can plan their finances accordingly, especially if they are looking for stable income rather than tax-saving benefits.

Advantages of Investing in Post Office FD

Investing in Post Office FDs has several advantages. First, it provides absolute safety as the deposits are backed by the government. Second, it offers guaranteed returns without market risk, which is ideal for risk-averse investors. Third, the FD allows flexibility in terms of deposit amount, tenure, and interest payout frequency. Additionally, the convenience of managing accounts at post offices across India makes it accessible even to those in smaller towns and rural areas.

Ideal Investors for Post Office FD

The Post Office FD is suitable for anyone looking for a low-risk, fixed-income investment. Retirees who want steady returns to supplement pensions, salaried professionals aiming to create a safe savings pool, and parents saving for their children’s education or marriage can all benefit from this scheme. It is also a good choice for individuals who prefer government-backed instruments over bank FDs or market-linked products, as it combines security with reasonable returns.

How to Open a Post Office FD Account

Opening a Post Office FD account is straightforward and convenient. Investors need to visit their nearest post office, submit required identification documents, and fill out a simple application form. Deposits can be made in cash, by cheque, or through bank transfers where available. Once the account is active, interest is calculated automatically, and the maturity amount can be claimed at the end of the tenure. Many post offices now provide online services to check balances, interest accrued, and manage multiple FD accounts efficiently.

Conclusion

The Post Office Fixed Deposit, along with the 2025 FD Calculator, offers a simple, safe, and reliable investment option for Indians. Whether investing ₹10,000 or ₹1 lakh, individuals can easily estimate returns and plan their finances with confidence. Its government backing, guaranteed returns, flexible tenure options, and accessibility make it a preferred choice for conservative investors and those seeking a secure way to grow their money. For anyone looking to invest safely and enjoy predictable growth, a Post Office FD is an excellent financial instrument.