Fixed deposits have always been considered a safe and reliable investment option for individuals looking to earn guaranteed returns. Among the many FD schemes available in India, Post Office fixed deposits hold a special place due to their government backing, assured interest, and widespread accessibility even in rural areas. Investors often search for clear details about how much return they can expect on different deposit amounts. Using the Post Office FD calculator, one can easily find out the maturity value of deposits ranging from ₹10,000 to ₹1 lakh.

What is a Post Office FD?

The Post Office fixed deposit, also called the Post Office Time Deposit (POTD), is a savings scheme offered by India Post under government security. The scheme allows investors to deposit money for a fixed tenure and earn interest at rates declared quarterly. Tenure options include 1 year, 2 years, 3 years, and 5 years. At the end of the term, the depositor receives the principal along with accumulated interest.

Since the scheme is government-backed, it is considered one of the safest investment instruments in the country. In addition, a 5-year Post Office FD qualifies for tax benefits under Section 80C of the Income Tax Act, making it popular among salaried as well as retired individuals.

Current Interest Rates on Post Office FD

The interest rate on Post Office FDs is revised every quarter by the Ministry of Finance. As of the latest update, the rates range between 6.9 percent and 7.5 percent depending on the tenure. A 1-year FD typically offers around 6.9 percent, while the 5-year FD offers up to 7.5 percent annually.

It is important for investors to check the latest rates before making a deposit since the return calculation depends entirely on the prevailing rate at the time of investment.

Benefits of Using a Post Office FD Calculator

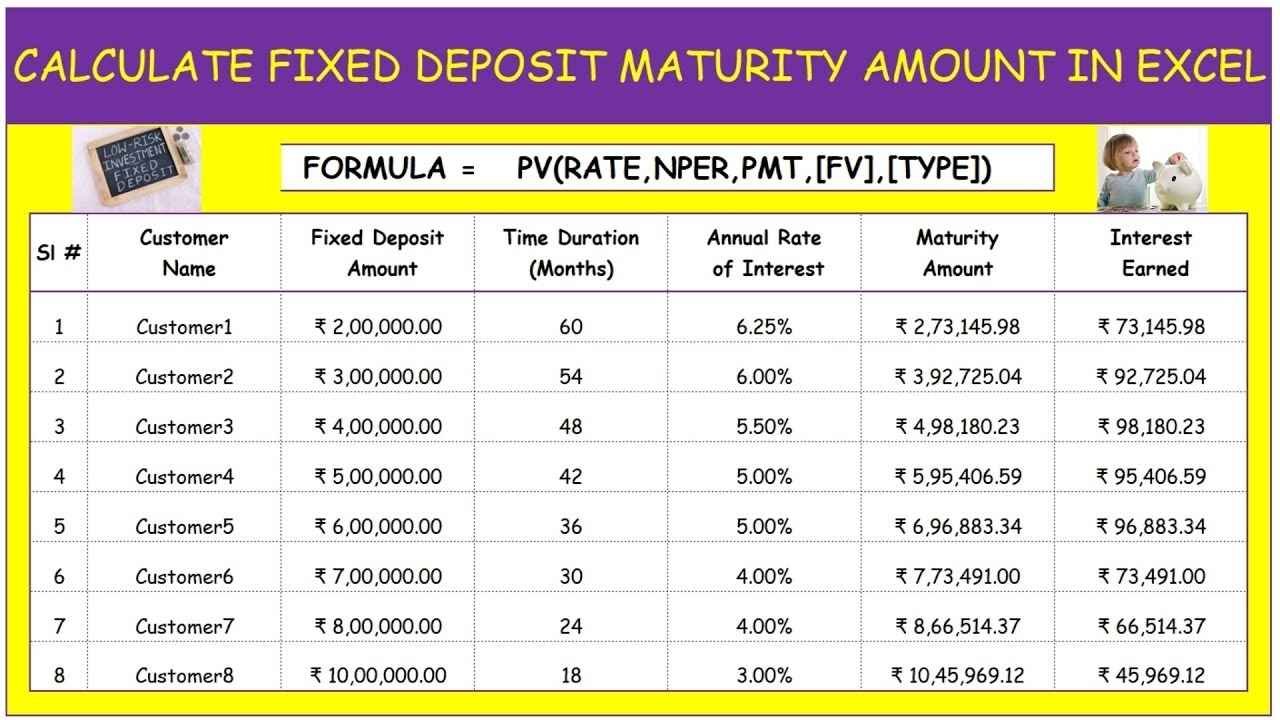

The FD calculator is an easy online tool that helps investors estimate how much maturity amount they will receive based on the deposit amount, tenure, and interest rate. Instead of manually calculating compound interest, the calculator provides instant and accurate results.

For example, if an investor deposits ₹20,000 for 5 years at an interest rate of 7.5 percent, the calculator instantly shows the total maturity value including the interest earned. This helps in comparing different investment amounts and tenures before making a decision.

Returns on ₹10,000 Deposit

If you invest ₹10,000 in a Post Office FD for 5 years at an interest rate of 7.5 percent, your maturity value will be around ₹14,370. The interest earned over the tenure will be approximately ₹4,370. For small savers, this provides a safe way to grow money with guaranteed returns.

Returns on ₹20,000 Deposit

For a ₹20,000 deposit at the same 5-year tenure and interest rate, the maturity value becomes approximately ₹28,740. This means you will earn around ₹8,740 in interest over 5 years. Investors who want to double their savings gradually can consider stepping up their investment amount.

Returns on ₹30,000 Deposit

Investing ₹30,000 in a 5-year Post Office FD will fetch a maturity value of around ₹43,110. The interest component here will be approximately ₹13,110. Many middle-income families prefer this range of investment for securing future expenses such as children’s education or marriage.

Returns on ₹40,000 Deposit

A ₹40,000 deposit will grow to about ₹57,480 over 5 years at 7.5 percent interest. The total interest earned will be ₹17,480. For those who want to keep their savings safe from market fluctuations while still earning steady returns, this option can be useful.

Returns on ₹50,000 Deposit

With a ₹50,000 deposit, the maturity amount at the end of 5 years would be nearly ₹71,850. The accumulated interest during this period would be ₹21,850. This investment size is often chosen by individuals planning for short-term financial goals while keeping their principal secure.

Returns on ₹1 Lakh Deposit

If you invest ₹1 lakh in a 5-year Post Office FD, your maturity value will be approximately ₹1,43,700. This means you earn ₹43,700 in interest over the tenure. For risk-averse investors, such as retirees or conservative savers, this becomes an attractive option since the capital is protected and returns are assured.

Factors to Consider Before Investing

While Post Office FDs are safe, there are certain factors to keep in mind before investing. Firstly, the interest earned is fully taxable under income tax laws. Secondly, the lock-in period means you cannot withdraw your money before maturity without facing penalties. Also, the interest rate remains fixed throughout the chosen tenure, which means you may miss out if rates rise in the future.

Despite these limitations, the scheme remains one of the most trusted investment choices for small and medium savers who value safety over high returns.

Who Should Invest in Post Office FDs?

Post Office FDs are best suited for individuals who prefer low-risk investments with guaranteed returns. Retirees, senior citizens, and those living in rural areas where banking services are limited find it particularly beneficial. Parents looking to set aside money for their children’s future also use these deposits as a disciplined savings tool.

Conclusion

The Post Office FD calculator provides a clear picture of how much you can earn on different deposit amounts such as ₹10,000, ₹20,000, ₹30,000, ₹40,000, ₹50,000, and ₹1 lakh. While the returns are modest compared to equities or mutual funds, the safety and government guarantee make it a reliable choice. For investors who prioritize security and assured returns, Post Office FDs continue to be a dependable part of financial planning.

Disclaimer

This article is meant for informational purposes only. Investors should check the latest interest rates and consult financial advisors before making investment decisions.

FAQs

1. What is the current interest rate on Post Office FD?

The current rate ranges from around 6.9 percent to 7.5 percent depending on the tenure.

2. Can I withdraw my Post Office FD before maturity?

Premature withdrawals are allowed but may attract penalties, reducing the effective return.

3. Is the interest earned on Post Office FD taxable?

Yes, the interest earned is fully taxable as per your income tax slab.

4. Does the 5-year Post Office FD offer tax benefits?

Yes, the 5-year FD qualifies for tax deductions under Section 80C up to ₹1.5 lakh.

5. Is Post Office FD better than a bank FD?

Both options are safe, but Post Office FDs are backed by the government, which adds an extra layer of security.