The Post Office Public Provident Fund (PPF) is one of the most trusted long-term investment options in India. Known for its tax benefits, guaranteed returns, and government backing, this scheme is often considered a safe choice for salaried individuals, business owners, and even homemakers. Many people prefer PPF because it not only grows their money steadily but also helps them save tax every year.

If you are wondering how an investment of just ₹25,000 can grow into ₹6.78 lakh under this scheme, it is important to understand how the calculation works, what interest rate is currently offered, and what other benefits the scheme provides.

What is the Post Office PPF Scheme

The Public Provident Fund was introduced in 1968 to encourage individuals to build long-term savings. It is available in both banks and post offices across the country, making it widely accessible. The scheme runs for 15 years, with an option to extend in blocks of 5 years.

The key attraction of PPF is that it combines guaranteed returns with tax-free income. It falls under the Exempt-Exempt-Exempt (EEE) category, which means the amount invested, the interest earned, and the maturity proceeds are all free from tax.

Current Interest Rate on PPF

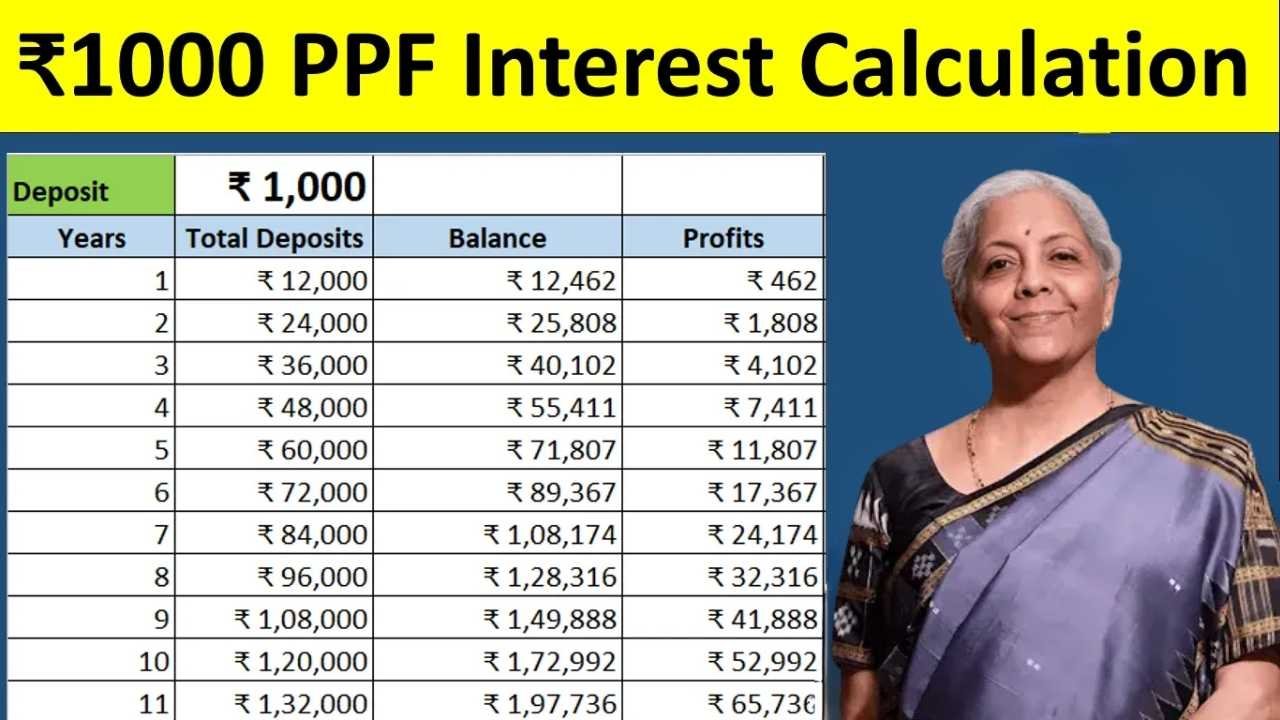

The government reviews and updates PPF interest rates every quarter. At present, the interest rate offered on PPF is 7.1 percent per annum. The returns are calculated on a yearly basis but the interest is compounded annually, which means your money grows faster over time.

At this rate, even a small but consistent investment can turn into a significant amount by the end of the maturity period.

Minimum and Maximum Investment in PPF

The PPF scheme is designed to suit every type of investor, from small savers to large depositors. The minimum investment required in a year is ₹500. On the other hand, the maximum deposit allowed in a financial year is ₹1.5 lakh.

Investors can make deposits in lump sum or in installments throughout the year. However, only 12 deposits are allowed in one financial year.

How ₹25,000 Can Grow to ₹6.78 Lakh

Now let us look at the calculation. If an investor deposits ₹25,000 every year into their PPF account, they will continue doing so for 15 years. With the current interest rate of 7.1 percent compounded annually, the total maturity amount comes to approximately ₹6,78,035 at the end of the tenure.

This calculation includes both the principal amount invested and the interest earned over the 15-year period. Even though the contribution seems small, the power of compounding helps in generating a much larger corpus.

Tax Benefits of PPF

One of the strongest features of PPF is the tax benefit it offers under Section 80C of the Income Tax Act. An investor can claim a deduction of up to ₹1.5 lakh in a financial year for the amount deposited in the PPF account.

Additionally, the interest earned each year and the final maturity amount are completely tax-free. This triple benefit makes PPF one of the most tax-efficient savings schemes available in India.

Rules for Withdrawal and Loan

Although the PPF account runs for 15 years, partial withdrawals are allowed from the 7th year onwards, subject to certain conditions. This feature ensures that investors can access funds in case of emergencies without closing the account.

Apart from withdrawals, investors can also take a loan against their PPF balance between the 3rd and 6th year of opening the account. The loan facility allows them to borrow at a lower rate of interest compared to personal loans from banks.

Extension of PPF Account

After completing the initial 15 years, investors have the option to extend their PPF account in blocks of 5 years. During the extension period, they can either continue to make fresh deposits or let the balance earn interest without additional contributions.

This flexibility makes PPF a powerful tool for long-term wealth creation and retirement planning.

Safety and Reliability

Since the PPF scheme is backed by the Government of India, the investment is completely safe. There is no risk of default, making it a preferred option for risk-averse individuals. Unlike mutual funds or stock investments, PPF is not affected by market fluctuations, which ensures stability.

Who Should Invest in PPF

PPF is suitable for anyone looking for a secure, long-term savings plan with the added advantage of tax benefits. It works best for:

- Salaried employees seeking safe retirement planning

- Self-employed individuals without access to EPF

- Parents saving for children’s education or marriage

- Risk-averse investors looking for guaranteed returns

Example for Different Contributions

If ₹25,000 every year can grow to ₹6.78 lakh, imagine how much more you can accumulate with higher contributions. For example, investing ₹50,000 annually would give you nearly double the corpus, and investing ₹1.5 lakh per year (the maximum allowed) can generate a maturity amount of over ₹40 lakh in 15 years at the current interest rate.

This shows how even modest annual savings, when done consistently, can create substantial wealth over time.

Conclusion

The Post Office PPF scheme is one of the safest and most rewarding investment options available in India. By depositing just ₹25,000 annually, an investor can accumulate ₹6.78 lakh in 15 years, all without paying any tax on the returns. With government backing, guaranteed interest, and the power of compounding, PPF remains a trusted choice for millions of Indians who want to secure their financial future.

Disclaimer

The information shared in this article is for educational purposes only. Interest rates, maturity values, and rules of the PPF scheme are subject to change as per government notifications. Investors are advised to check the latest details on the official India Post or Ministry of Finance website before making any financial decision.

FAQs

1. What is the maturity period of the PPF scheme

The PPF scheme has a maturity period of 15 years, which can be extended in blocks of 5 years.

2. What is the current rate of interest on PPF

The present rate of interest on PPF is 7.1 percent per annum, compounded annually.

3. Can I withdraw money before 15 years in PPF

Yes, partial withdrawals are allowed from the 7th year onwards under specific conditions.

4. Is PPF investment tax-free

Yes, the invested amount, annual interest, and maturity proceeds are all exempt from tax.

5. How much can I invest in PPF in a year

The minimum investment is ₹500 and the maximum is ₹1.5 lakh per financial year.