Investing money wisely has become one of the most important priorities for people today. With increasing expenses and the constant need for financial security, individuals are looking for safe and guaranteed return options. Among various investment opportunities available in India, the Post Office National Savings Certificate (NSC) stands out as a reliable scheme. Backed by the Government of India, this plan not only ensures security but also provides attractive returns over a fixed tenure. Many investors are surprised to know that with smart planning, it is possible to build a corpus of nearly 58 lakh rupees in just five years through this scheme.

What is the Post Office NSC Scheme

The National Savings Certificate is a fixed-income savings scheme offered by India Post. It is specially designed for small and medium investors who want to grow their savings without taking high risks. The scheme has a tenure of five years, and the returns are predetermined, which means investors know exactly how much they will receive at maturity. Since the scheme is government-backed, there is no fear of losing the invested money, making it an excellent choice for risk-averse individuals.

Key Features of NSC

The NSC offers a range of features that make it popular among investors. The minimum investment starts with a small amount, making it accessible to people from different financial backgrounds. There is no maximum limit, so one can invest as per their capacity and goals. The interest rate is revised by the government every quarter, and the interest earned gets compounded annually but is paid only at maturity. Another benefit is the tax deduction under Section 80C of the Income Tax Act, allowing investors to save up to 1.5 lakh rupees every year on taxable income.

How NSC Can Help Build a Large Corpus

When we talk about accumulating nearly 58 lakh rupees in five years, it is important to understand that such wealth creation is possible through disciplined and systematic investment. Suppose an investor puts in a significant lump sum amount or continues to reinvest the returns in multiple certificates, the power of compounding comes into play. The interest that is generated each year is added back to the investment, and this process continues till the maturity period ends. By the time five years are over, the accumulated interest along with the principal creates a large maturity amount.

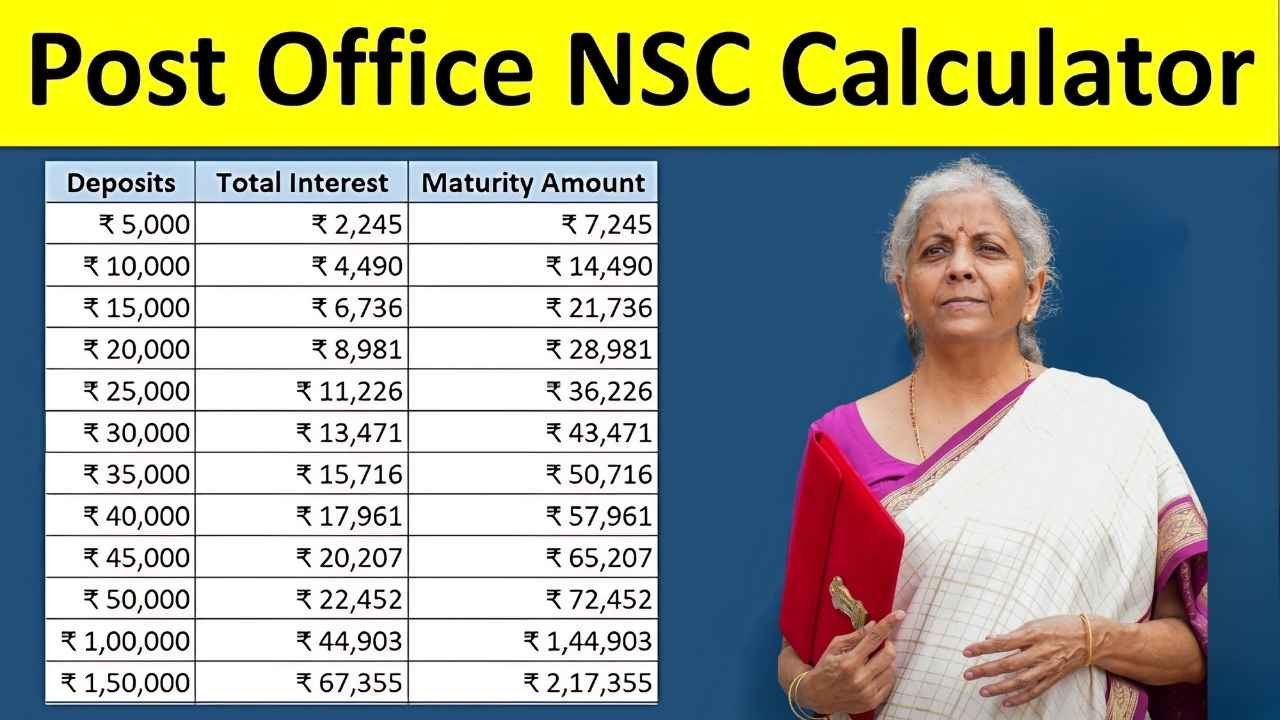

Calculation of Returns in Five Years

The exact maturity value depends on the prevailing interest rate, which is generally higher than that of regular savings accounts or fixed deposits in banks. Let us assume the interest rate offered is around 7.7 percent annually. If an investor invests a large amount in NSC and keeps reinvesting in new certificates, the maturity value can touch close to 58 lakh rupees in five years. The key factor here is consistent reinvestment and patience to let the money grow without premature withdrawals.

Why Choose NSC Over Other Investments

While there are many investment avenues like mutual funds, stocks, or fixed deposits, the NSC comes with unmatched safety. Stock markets are volatile and can cause losses if not managed carefully. Mutual funds also involve market risk, and their returns are not guaranteed. Fixed deposits provide stable returns, but the rates are usually lower than NSC. In comparison, the NSC balances both safety and returns effectively. It is particularly suitable for conservative investors, retired individuals, and people who prefer assured returns rather than market-linked earnings.

Tax Benefits with NSC

One of the most attractive aspects of NSC is its tax-saving feature. Under Section 80C, investments up to 1.5 lakh rupees per year are eligible for deduction. Additionally, the interest earned every year (except in the final year) is also considered reinvested, which means it qualifies for tax deduction as well. This dual advantage not only helps investors save on tax but also accelerates the growth of their money.

Steps to Invest in NSC

Investing in NSC is simple and hassle-free. An individual can visit the nearest post office with identity proof, address proof, and a passport-size photograph to open the account. Both single and joint accounts are allowed. Investors can choose to hold the certificate physically or in electronic form. The ease of access and minimum paperwork make it convenient even for first-time investors.

Who Should Invest in NSC

The NSC is ideal for people who want risk-free investments with guaranteed returns. Salaried individuals looking for tax savings, parents planning for their children’s future education, and retirees who want safe investments can all benefit from this scheme. Since there is no market dependency, it brings peace of mind and financial stability.

Final Thoughts

The Post Office National Savings Certificate is one of the best investment options for individuals seeking safety, reliability, and decent returns. With the right planning and consistent investment, it is possible to create a substantial corpus that can support financial goals. The idea of turning savings into nearly 58 lakh rupees within just five years is achievable with NSC when investors commit to disciplined investing. For anyone who values security along with growth, NSC stands as a trustworthy choice that continues to serve millions of Indians as a pillar of financial planning.

Disclaimer

The information provided in this article is for educational and informational purposes only. Investment values, returns, and calculations mentioned are based on current available data and may vary with changes in government policies or interest rates. Readers are advised to consult with a certified financial advisor or official post office representatives before making any investment decisions.