For Indian investors who prefer safety, steady returns, and complete government backing, the Post Office Monthly Income Scheme, popularly known as MIS, has always been a reliable choice. In 2025, this scheme continues to provide one of the most secure ways to generate fixed monthly income without market risks. It is especially helpful for senior citizens, homemakers, and individuals who want regular interest income instead of waiting for maturity.

What is Post Office Monthly Income Scheme

The Post Office Monthly Income Scheme is a government-backed savings plan where a lump sum deposit is made, and the investor receives interest payouts every month. Unlike other schemes where returns are paid only at maturity, this plan ensures a fixed monthly flow of money, making it ideal for those who want to supplement their income. The principal amount remains safe with the post office, and interest is credited every month directly into the account.

How the Scheme Works

An investor deposits a fixed sum into the scheme for a tenure of five years. The minimum investment amount is one thousand five hundred rupees, while the maximum limit is nine lakh rupees for a single account and fifteen lakh rupees for a joint account. Once the deposit is made, interest is calculated based on the prevailing rate and credited monthly. At the end of the five-year period, the original investment is returned to the account holder.

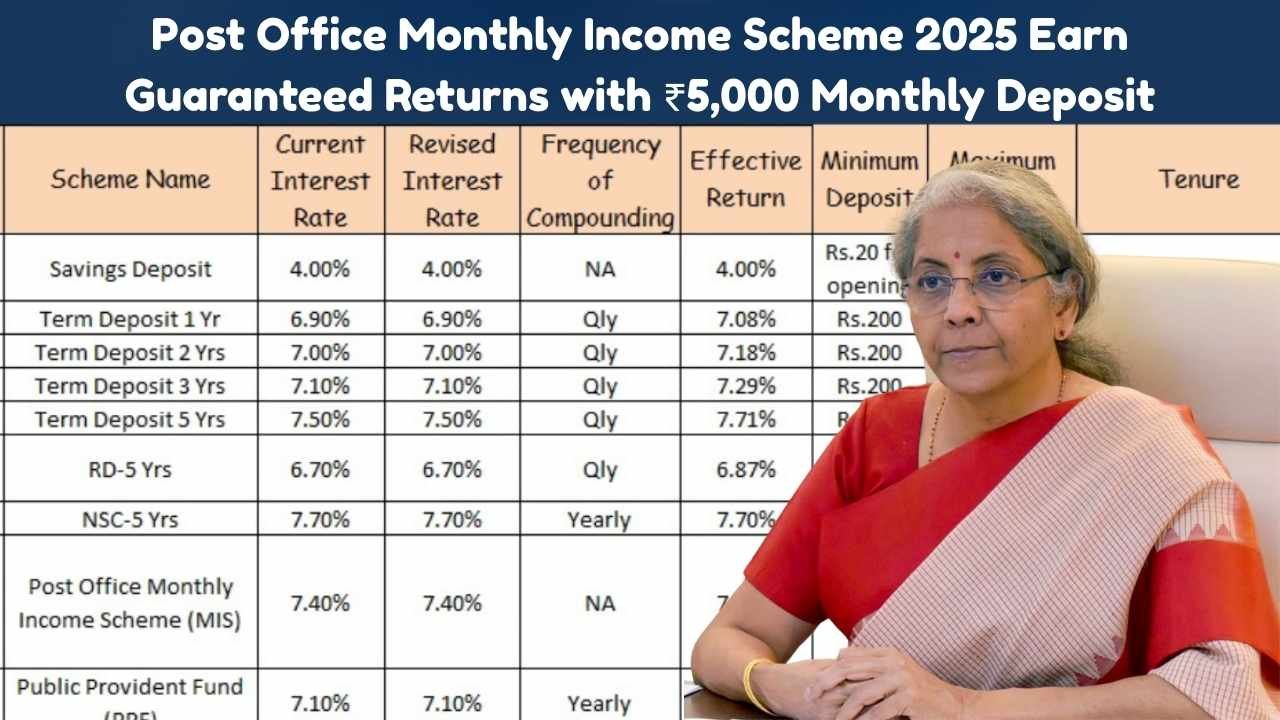

Interest Rates in 2025

The Government of India revises interest rates on small savings schemes every quarter. As of 2025, the Post Office Monthly Income Scheme is offering an annual interest rate of 7.4 percent. This means if an investor puts in five thousand rupees every month over the period, they will start receiving fixed monthly income based on the accumulated deposit. For example, with a lump sum investment of nine lakh rupees, the monthly interest comes to around five thousand five hundred rupees. This steady payout helps households manage regular expenses without touching their savings.

Example of Returns on ₹5,000 Monthly Investment

To understand the benefit more clearly, let us assume an investor deposits five thousand rupees each month in the scheme. Over five years, the total investment will be three lakh rupees. With the current interest rate, the investor will receive monthly interest income, and at maturity, the entire principal amount of three lakh rupees will be returned. This way, the scheme serves two purposes: it generates fixed income every month and also preserves the capital for the long term.

Eligibility and Account Opening

The scheme is open to all resident Indian citizens. Any adult can open a single account, and joint accounts can also be created with up to three individuals. Parents or guardians can open accounts on behalf of minors, making it flexible for families. Non-resident Indians are not eligible to invest. To open an account, an investor needs to visit the nearest post office with identity proof, address proof, passport-size photographs, and the initial deposit amount. Many post offices now provide digital facilities through India Post Payments Bank, making the process more convenient.

Benefits of the Scheme

The biggest advantage of this scheme is the safety of capital, as it is backed by the Government of India. The regular monthly payout makes it highly suitable for retirees and families looking for a fixed income source. Interest rates are higher than most traditional bank savings accounts, and the account can be easily transferred from one post office to another anywhere in India. The scheme also allows nomination, ensuring that the investment can be passed on easily to family members in case of an unfortunate event.

Tax Implications

Although the scheme offers safe and assured returns, investors must keep in mind the tax implications. The interest earned on the Post Office Monthly Income Scheme is fully taxable according to the investor’s income tax slab. There is no tax deduction available under Section 80C for the deposit amount. Therefore, while the scheme is a great option for safe returns, it does not provide additional tax-saving benefits.

Limitations to Consider

Like all investment plans, this scheme too has certain limitations. Since the interest earned is taxable, the effective return may be slightly lower for individuals in higher tax brackets. The scheme has a lock-in period of five years, and premature withdrawal is allowed only after one year with certain penalties. Additionally, as the rate of interest is fixed, it does not provide protection against inflation. Over a long period, the real value of returns may decrease compared to market-linked investments.

Who Should Invest in Post Office Monthly Income Scheme

This scheme is most suitable for senior citizens who want a steady income after retirement, for homemakers who need regular cash flow to manage household expenses, and for conservative investors who prefer security over high-risk returns. Salaried individuals looking to create a secondary income stream can also benefit from it. With its government guarantee and ease of access, the scheme is a dependable option for those who value safety and assured income above all.

Conclusion

The Post Office Monthly Income Scheme in 2025 continues to be one of the most trusted small savings plans in India. With a secure structure, guaranteed monthly returns, and complete government backing, it provides peace of mind to investors who want to protect their savings and earn regular income. While it may not provide tax benefits or inflation-beating returns, it remains an ideal option for people seeking stability and financial security in their monthly budgets.

Disclaimer

This article is meant for informational purposes only. Interest rates and rules are subject to change as per government updates. Investors are advised to check the latest details at their nearest post office or the official India Post website before investing.