The Indian Post Office has always been more than just a mail delivery system. For decades, it has played an important role in bringing financial services to people across the country, especially in rural and semi-urban areas where banking and insurance facilities are limited. Among its many offerings, the Post Office Life Insurance Scheme, also known as PLI, has gained popularity as a reliable and affordable way to secure the future of individuals and their families. In 2025, the scheme continues to offer a wide range of plans with attractive benefits, simple eligibility, and reasonable premiums.

Introduction to Post Office Life Insurance Scheme

The Post Office Life Insurance Scheme was first introduced in 1884 for postal employees, but over the years it has been expanded to cover government workers, professionals, and ordinary citizens. It is one of the oldest life insurance schemes in India and is operated by the Department of Posts under the Ministry of Communications. Unlike private insurers, the PLI is fully backed by the Government of India, which makes it a safe and trustworthy option for policyholders.

The scheme is designed to provide financial protection in the event of the policyholder’s death and also offers savings and investment opportunities. With its strong presence in every corner of the country, the post office makes it easy for people to buy and manage life insurance without complicated procedures.

Plans Offered Under Post Office Life Insurance in 2025

The Post Office Life Insurance Scheme offers a variety of plans to suit different needs and budgets. Some plans focus on pure protection, while others combine protection with savings and investment benefits. There are also endowment and whole life plans that ensure long-term financial stability. In 2025, the post office continues to provide flexible insurance solutions that cover individuals from different age groups and professions. These plans include options for term assurance, whole life coverage, convertible policies, and endowment plans that provide both maturity value and death benefit.

Benefits of the Post Office Life Insurance Scheme

The biggest advantage of the scheme is the security of being backed by the Government of India, which assures policyholders that their investments are safe. Premiums under PLI are generally lower compared to many private insurers, making it an affordable choice for middle-income families. The scheme also provides attractive bonuses that are declared periodically, increasing the maturity value of the policy. Policyholders can take loans against their policies after a certain period, which adds liquidity in times of need. The claim settlement process is straightforward and reliable, giving families peace of mind during difficult times.

In addition to financial protection, the scheme encourages savings and disciplined investments, which can help policyholders build a financial cushion for future needs like children’s education, marriage expenses, or retirement.

Eligibility for the Scheme

The eligibility criteria for the Post Office Life Insurance Scheme are simple and inclusive. Any Indian citizen within the specified age limits can apply, provided they meet the basic health requirements. Initially, the scheme was limited to government and semi-government employees, but it has now been extended to cover professionals, working individuals, and certain categories of the general public. The minimum and maximum entry age, as well as the maximum maturity age, vary depending on the type of plan chosen. Applicants are generally required to undergo a basic medical check-up before the policy is issued.

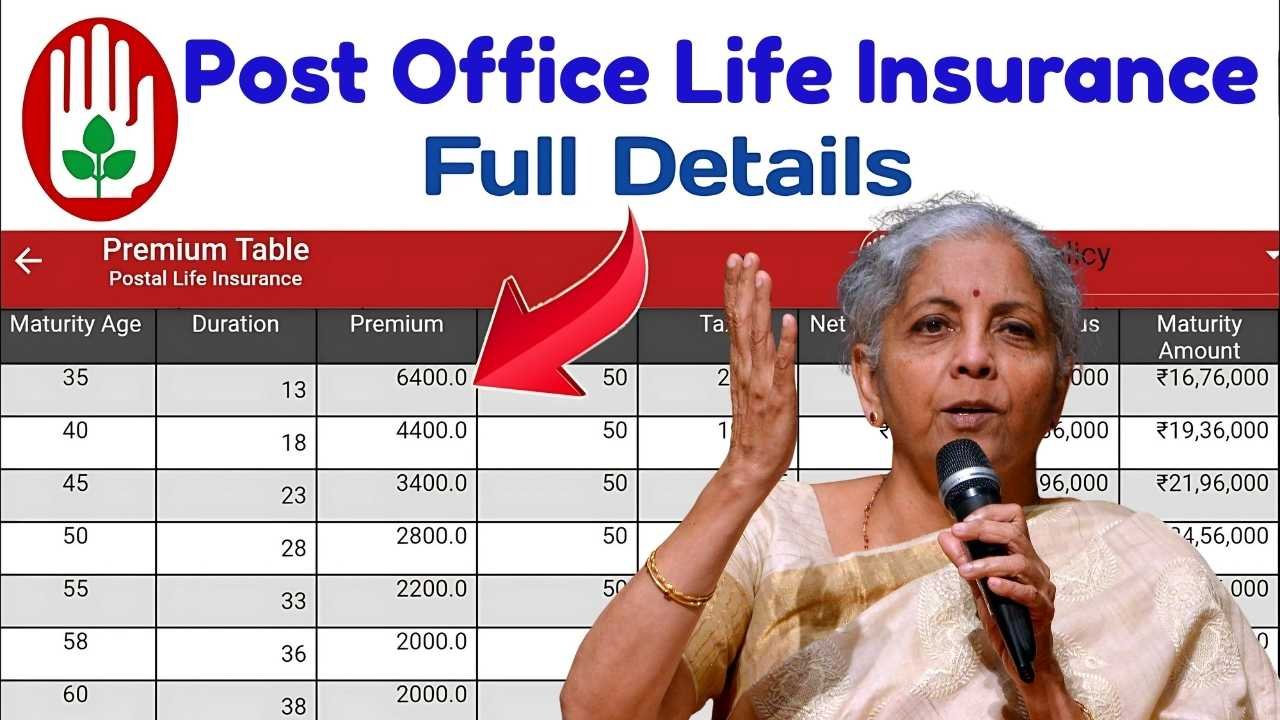

Premium Details and Payment Options

The Post Office Life Insurance Scheme is known for its affordable premium rates. The premium depends on the plan selected, the sum assured, and the age of the policyholder. Since the scheme is government-backed, the rates are competitive and designed to be within the reach of average citizens. Premiums can be paid monthly, quarterly, half-yearly, or annually, giving flexibility to policyholders. Payment can be made directly at the post office or through online facilities, making it convenient for those who cannot visit the post office frequently.

The affordability of premiums, combined with the bonus benefits declared from time to time, makes the scheme one of the most attractive life insurance options available in India.

How to Apply for Post Office Life Insurance in 2025

Applying for the scheme is simple. An individual can visit the nearest post office and collect the proposal form for life insurance. The form requires basic personal, occupational, and medical details. After submission, a medical examination may be conducted depending on the sum assured and age of the applicant. Once the application is verified and approved, the policy document is issued. The process has also been digitized, allowing people to apply online through the official India Post Insurance portal, which makes it easier for working professionals and urban customers.

Why Choose Post Office Life Insurance

There are several reasons why people prefer the Post Office Life Insurance Scheme over private insurance companies. The government guarantee ensures complete safety of investment. The premium rates are low, and the bonus returns are attractive compared to many other schemes. The post office has one of the largest networks in the country, which means policyholders can access services even in remote areas. The simplicity of procedures and the personal assistance available at local post offices make it user-friendly, especially for people who are not comfortable with complicated financial products.

Challenges and Future Outlook

Despite its many advantages, the scheme still faces challenges such as lack of awareness among the masses, especially in rural areas. Many people are still unaware of the wide range of insurance plans available under PLI. Digital adoption is improving but still needs to be strengthened to make the scheme more accessible to the younger population that prefers online services. In the future, with greater promotion, better digital integration, and more customer-friendly innovations, the Post Office Life Insurance Scheme has the potential to become one of the leading life insurance providers in the country.

Conclusion

The Post Office Life Insurance Scheme in 2025 continues to be one of the most trusted and affordable life insurance options available to Indian citizens. With a range of plans that cater to different financial needs, low premium rates, government backing, and reliable claim settlement, it offers a secure way to protect the future of families. Whether it is financial security, savings, or investment with assured returns, the scheme provides a comprehensive package that meets the needs of both rural and urban populations. For anyone looking for a safe, simple, and trustworthy insurance option, the Post Office Life Insurance Scheme remains a strong choice.

Disclaimer

The information provided in this article about the Post Office Life Insurance Scheme 2025 is intended for general awareness and educational purposes only. While efforts have been made to ensure accuracy, policy details, premium rates, and eligibility conditions may change as per official government notifications or India Post guidelines. Readers are advised to verify the latest information from authorized sources or consult with the nearest post office before making any financial or investment decisions. The author and publisher are not responsible for any errors, omissions, or subsequent changes in scheme rules.