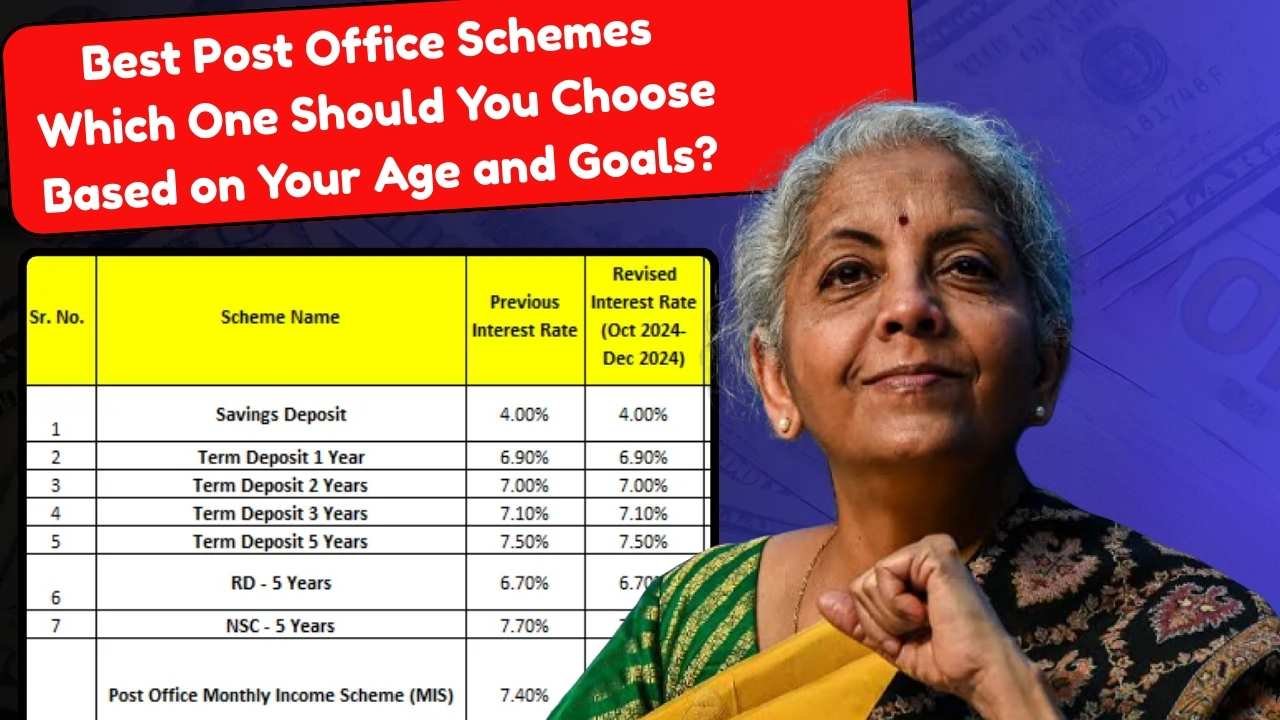

India Post has long been a trusted name when it comes to safe and reliable savings options. The Post Office savings schemes are not only backed by the Government of India but also provide assured returns, tax benefits, and flexible investment choices for people of all age groups. In 2025, these schemes continue to be a preferred choice for individuals who want to grow their savings without taking high risks. However, choosing the right scheme depends on your age, financial goals, and investment horizon. Let’s explore the best post office schemes in 2025 and find out which one suits you the most.

Why Choose Post Office Schemes?

The biggest advantage of Post Office savings schemes is their safety. Since these schemes are government-backed, there is no risk of default. They are ideal for conservative investors who prefer guaranteed returns over market-linked risks. These schemes also offer flexible options such as monthly income, long-term savings, retirement benefits, and tax exemptions under Section 80C of the Income Tax Act.

Best Post Office Schemes for Young Investors (Age 20–35)

At this stage of life, the primary focus is on wealth creation and disciplined saving habits. While young investors may also explore equities and mutual funds, post office schemes can add a secure base to their portfolio.

Recurring Deposit (RD)

A Post Office RD allows you to deposit a fixed amount every month for five years. The interest is compounded quarterly, ensuring steady growth. For young earners, it helps in building a regular savings habit without putting too much pressure on finances.

National Savings Certificate (NSC)

This is a fixed-income investment for five years with attractive interest rates. It is suitable for salaried individuals who want assured returns along with tax savings under Section 80C. The reinvestment of interest ensures better maturity value.

Sukanya Samriddhi Yojana (SSY)

For young parents, this is one of the most rewarding schemes. It is designed to secure the future of a girl child with high interest rates and tax benefits. The account can be opened before the girl turns 10 and continues until 21 years, making it an excellent long-term investment.

Best Post Office Schemes for Mid-Age Investors (Age 35–50)

This age group is usually focused on balancing family responsibilities, children’s education, and long-term wealth creation. Stability and predictable returns are very important.

Kisan Vikas Patra (KVP)

KVP doubles your investment in a fixed period, which is usually around 10 years depending on the current interest rate. It is ideal for those looking to park surplus funds safely for the future without worrying about market volatility.

Monthly Income Scheme (MIS)

For families seeking a steady flow of income, MIS is a great choice. You can invest a lump sum and receive guaranteed monthly interest payouts. This scheme is best for individuals who want an additional source of income while keeping their capital safe.

Public Provident Fund (PPF)

Even though it has a 15-year lock-in, PPF remains one of the most popular choices for mid-age investors. It offers tax-free returns, attractive interest rates, and the safety of government backing. Partial withdrawals are allowed after a certain period, making it flexible for emergencies.

Best Post Office Schemes for Senior Citizens (Age 50 and Above)

For senior citizens, the key focus is security of capital and a regular flow of income. Post Office schemes provide multiple options suited to this requirement.

Senior Citizens Savings Scheme (SCSS)

One of the most preferred schemes, SCSS offers higher interest rates exclusively for individuals above 60 years of age. The tenure is five years, extendable by three more years. It provides quarterly interest payouts, ensuring a reliable source of income after retirement.

Post Office Fixed Deposit (FD)

FDs in post offices provide guaranteed returns with flexible tenure ranging from 1 to 5 years. They are best for seniors who prefer short-term safe investments.

Monthly Income Scheme (MIS) for Pensioners

This scheme is particularly useful for retired individuals who depend on fixed monthly earnings. By investing a lump sum, pensioners can ensure regular income without dipping into their savings.

Tax Benefits of Post Office Schemes

Most Post Office schemes are eligible for tax deductions under Section 80C of the Income Tax Act, up to a limit of Rs. 1.5 lakh per financial year. PPF and Sukanya Samriddhi Yojana also provide tax-free returns at maturity, which makes them highly attractive for long-term planning. However, schemes like MIS and SCSS provide taxable interest, though they are still considered safe compared to other income sources.

Which Scheme Should You Choose?

The right Post Office scheme depends on your financial goals and age group:

- Young professionals can start with RD, NSC, or PPF for disciplined long-term saving.

- Mid-age investors can diversify into MIS, KVP, and PPF to balance safety with returns.

- Senior citizens should prioritize SCSS and MIS for regular income post-retirement.

- Parents with daughters should invest in Sukanya Samriddhi Yojana for her future financial security.

Conclusion

Post Office savings schemes in 2025 remain one of the safest and most reliable investment choices in India. Whether you are a young professional just starting your career, a middle-aged family person planning for the future, or a senior citizen looking for steady income, there is a scheme that fits your needs perfectly. By aligning your choice with your age and financial goals, you can create a secure and balanced financial plan without worrying about market risks.

Disclaimer

The information provided in this article is for educational and general awareness purposes only. Post Office schemes, interest rates, and benefits may change from time to time as per government notifications. Readers are advised to check the latest official updates or consult a qualified financial advisor before making any investment decisions.