The Post Office National Savings Certificate (NSC) is one of the safest and most reliable investment options available in India. It is a government-backed scheme designed to provide secure returns while helping individuals build a substantial corpus over a fixed period. By investing strategically in NSC, it is possible to grow your money to nearly ₹58 lakh in five years, making it an attractive choice for risk-averse investors looking for guaranteed growth.

Key Features of the NSC Scheme

The NSC scheme is popular because it offers a combination of safety, simplicity, and fixed returns. The scheme has a tenure of five years, making it a medium-term investment option suitable for building wealth steadily. The minimum investment starts at ₹100, while there is no strict upper limit, allowing investors to deposit as much as they are comfortable with. The interest rate is set by the government and compounded annually but paid at maturity. One of the notable benefits is that investments in NSC qualify for tax deduction under Section 80C, making it both a wealth-building and tax-saving tool.

How NSC Interest is Calculated

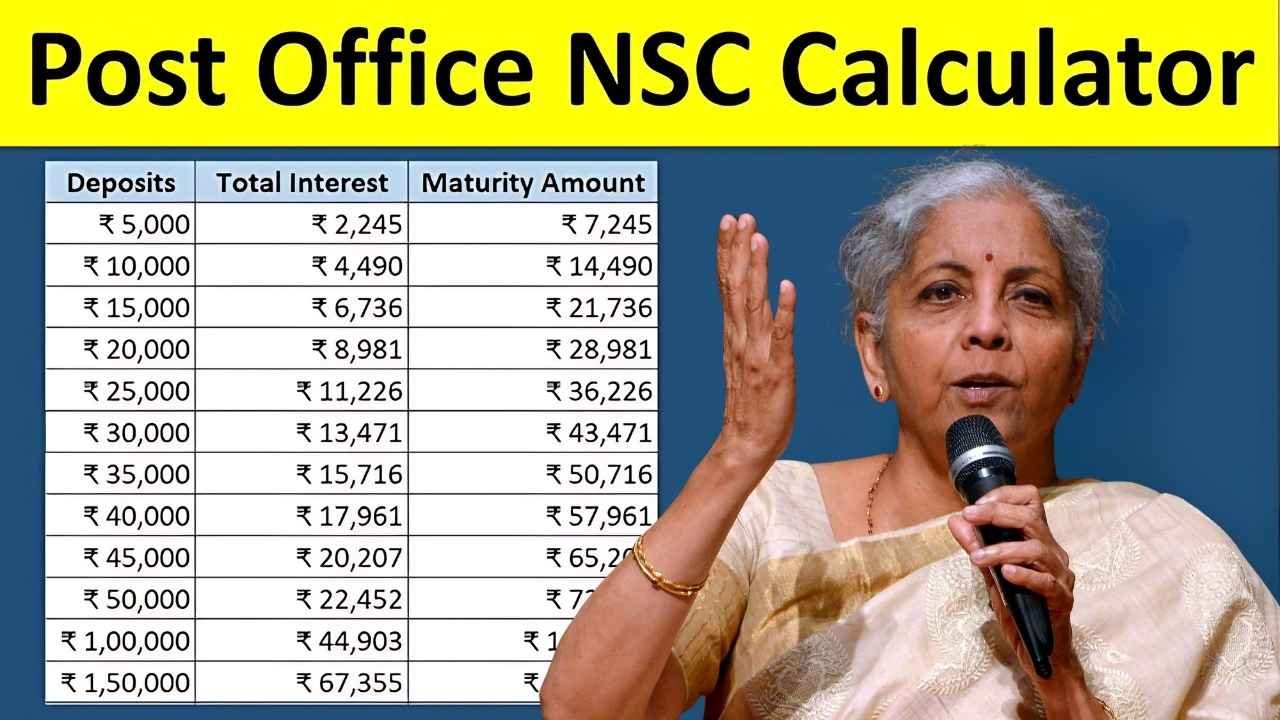

Interest in the NSC scheme is compounded annually but payable only at maturity. The interest rate is fixed by the government and reviewed periodically. For example, if the current rate is 7.1% per annum, the interest compounds each year, which means your earnings also start earning interest over time. This compounding effect plays a significant role in growing your investment substantially over the five-year tenure. By using the NSC calculator or a simple manual calculation, investors can estimate their maturity amount accurately.

Example: Growing Your Investment to Nearly ₹58 Lakh

To illustrate, consider an investor aiming for a corpus of nearly ₹58 lakh in five years. By making regular and significant investments in NSC, the power of compounding works to grow the principal amount and interest together. For instance, investing large sums at the start or using systematic investments each year can lead to impressive returns over five years. While the exact amount depends on the invested capital and the prevailing interest rate, careful planning ensures that NSC can become a reliable tool for achieving long-term financial goals safely.

Benefits of Investing in NSC

One of the biggest advantages of the NSC scheme is the safety of your investment, as it is fully backed by the government. There is no risk of losing your principal, making it ideal for conservative investors. The fixed interest rate provides certainty in returns, which is particularly useful in volatile market conditions. Additionally, the scheme encourages disciplined savings due to its fixed tenure and compounding benefits. It is suitable for a wide range of investors, from first-time savers to experienced individuals seeking tax-efficient, risk-free growth.

Tax Benefits of NSC

Investments in NSC qualify for deductions under Section 80C of the Income Tax Act up to a limit of ₹1.5 lakh per year. This helps reduce taxable income while allowing your investment to grow. The interest earned each year is reinvested and counts toward tax benefits in the following years. However, interest accrued is taxable at maturity, so it is important for investors to plan for the tax implications to maximize the net returns.

How to Invest in NSC

Investing in NSC is straightforward and can be done at any post office across India. You need to fill out the application form, submit identity and address proofs, and deposit the principal amount. Payments can be made via cash, cheque, or online transfer, depending on the post office facilities. Investors can hold certificates in physical form or through dematerialized accounts, providing flexibility in managing investments. The simplicity of the process and accessibility of NSC make it one of the most popular investment options for all age groups.

Why NSC is Ideal for Safe Growth

The NSC scheme is particularly suited for individuals who prefer risk-free investment options with guaranteed returns. Unlike market-linked products, NSC eliminates the uncertainty of market fluctuations while still offering competitive interest rates. Its government backing ensures complete security, and the compounding interest mechanism allows investors to build a substantial corpus over time. Whether for retirement planning, children’s education, or long-term wealth accumulation, NSC is a dependable instrument for achieving financial goals safely.

Conclusion

The Post Office NSC scheme is an excellent choice for individuals seeking safe, medium-term investment with guaranteed returns. By planning investments carefully, it is possible to grow a substantial corpus, potentially reaching nearly ₹58 lakh in five years, depending on the invested amount and interest rates. The combination of government backing, tax benefits, compounding growth, and simplicity makes NSC a highly attractive investment option. For anyone looking to build wealth safely and achieve predictable financial growth, the NSC scheme remains a reliable and rewarding choice.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. Returns mentioned are based on the current government-declared interest rates and are subject to change. Investors should consult a certified financial advisor or visit the official Post Office website before making any investment decisions.

Frequently Asked Questions (FAQs)

1. What is the minimum and maximum investment in NSC?

The minimum investment is ₹100, and there is no strict upper limit, allowing investors to deposit as much as they wish.

2. How is interest calculated in the NSC scheme?

Interest is compounded annually but paid at maturity. The rate is fixed by the government and reviewed periodically.

3. Can NSC investments qualify for tax benefits?

Yes, investments in NSC qualify for deduction under Section 80C up to ₹1.5 lakh per financial year.

4. Can I withdraw money from NSC before maturity?

Premature withdrawals are allowed only under specific circumstances such as the death of the investor or by surrender after a minimum lock-in period, subject to government rules.

5. Is NSC a safe investment option?

Yes, NSC is fully backed by the Government of India, making it a safe and risk-free investment choice with guaranteed returns.