The Post Office Monthly Income Scheme (POMIS) is a reliable way to secure a fixed income every month. If you are looking to invest your savings safely while ensuring a steady monthly income, POMIS is an ideal choice. This scheme is especially beneficial for individuals who want regular income for retirement or household expenses. It allows you to invest a fixed amount each month and enjoy guaranteed returns with the safety of government-backed investment.

Benefits of Investing in POMIS

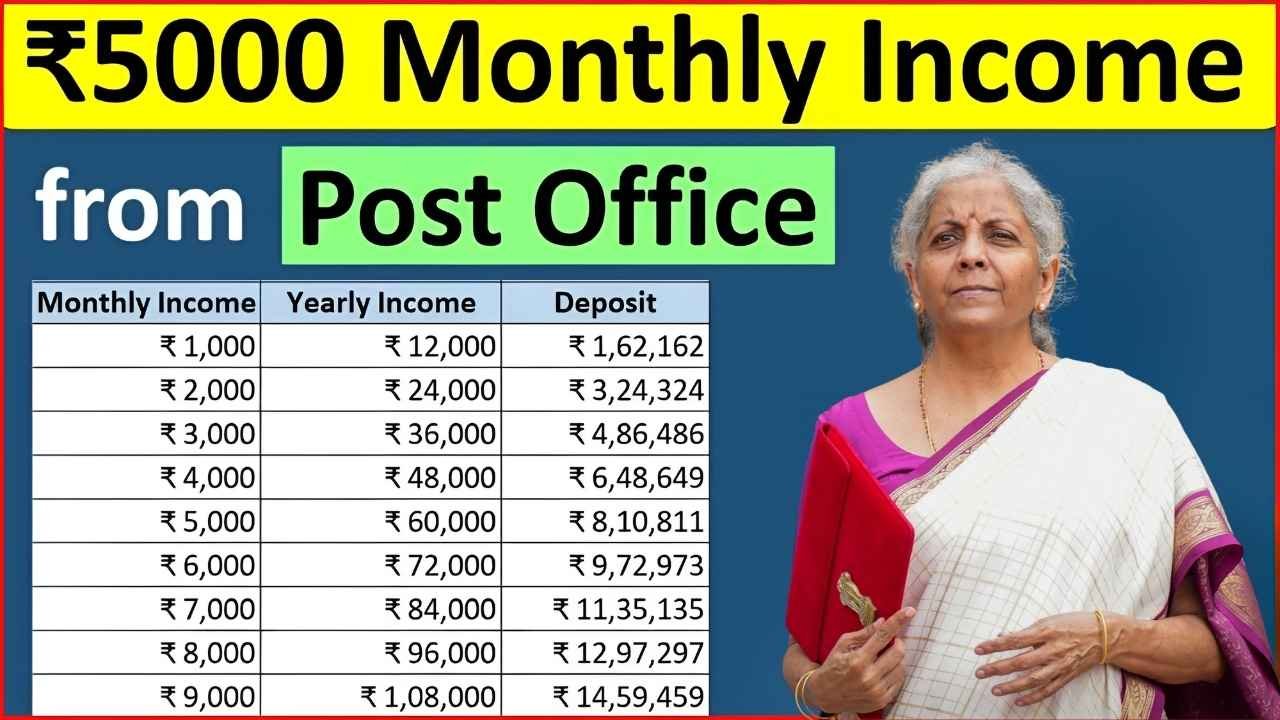

Investing in POMIS comes with several advantages. The most significant benefit is the monthly fixed income, which helps you manage your regular expenses easily. Another advantage is the security of your principal amount since it is backed by the government. The scheme is flexible and allows you to start with small investments. For instance, a monthly deposit of ₹5,000 can provide a predictable income stream, making it easier to plan your finances effectively.

Key Features of the Scheme

POMIS offers several features that make it an attractive investment option. The minimum deposit starts at ₹1,500, while the maximum limit for an individual is ₹4.5 lakh. If you open a joint account, the maximum limit extends to ₹9 lakh. The scheme has a tenure of five years, and at maturity, you receive both your principal and interest. The interest rate is revised quarterly by the government and is competitive compared to other fixed-income options.

How to Invest in POMIS

Investing in POMIS is straightforward. You can visit any post office branch to fill out the application form and make the initial deposit. Along with the form, you need to submit identity and address proof. You can open a single or joint account and choose a deposit amount that suits your financial goals. In addition to monthly deposits, one-time lump sum deposits are also allowed, offering flexibility for different financial situations.

How Monthly Income Works

One of the major advantages of POMIS is the regular monthly income it provides. The interest is credited to your account every month, allowing you to use it for personal expenses. For example, if you invest ₹5,000 per month, you will receive fixed monthly interest based on the current rate set by the government. This predictable income helps in financial planning, ensures smooth cash flow, and provides a safety net in case of emergencies.

Eligibility for POMIS

The eligibility criteria for POMIS are simple. Investors must be at least 18 years old. Senior citizens can also invest in the scheme and often receive slightly higher interest rates. Only permanent residents of India can participate. A bank account or a post office savings account is required to facilitate deposits and interest transfers, making the process easy and convenient.

POMIS and Financial Planning

In today’s world, having safe and predictable sources of income is essential. POMIS serves as a secure option for retirement planning, household budgeting, and long-term savings. Regular monthly income helps reduce financial stress and uncertainty while allowing you to manage daily expenses effectively. It can serve as a stable component of your investment portfolio, offering both security and predictability.

Conclusion

The Post Office Monthly Income Scheme is a safe and reliable investment that guarantees monthly income. By investing ₹5,000 per month, you can enhance your financial security and create a predictable income source for the future. Its simplicity, government backing, and fixed returns make it suitable for people of all age groups. POMIS not only provides safety but also aids in long-term financial planning. If you want to invest your savings smartly and enjoy a steady monthly income, the Post Office Monthly Income Scheme is an excellent choice.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. Investments in the Post Office Monthly Income Scheme are subject to government regulations, interest rate changes, and terms and conditions of the scheme. Readers should consult with a certified financial advisor or visit the official post office website before making any investment decisions.