In the world of personal finance, many people search for an investment that provides both security and regular income. For individuals who want stability without taking risks in the stock market, the Post Office Monthly Income Scheme (MIS) continues to be a trusted choice. In 2025, this government-backed savings scheme remains a safe investment option, especially for retirees, homemakers, and those who prefer guaranteed monthly earnings. The Post Office MIS combines the assurance of fixed returns with the reliability of a government guarantee, making it one of the most preferred income-generating tools in India.

What is the Post Office Monthly Income Scheme?

The Monthly Income Scheme is a savings plan offered through India Post. It allows investors to deposit a lump sum amount and receive a fixed monthly payout in the form of interest. This makes it ideal for those who want a steady flow of income without worrying about market risks. The scheme is backed by the Government of India, which means that both the principal amount and the interest are completely secure.

Key Features of MIS in 2025

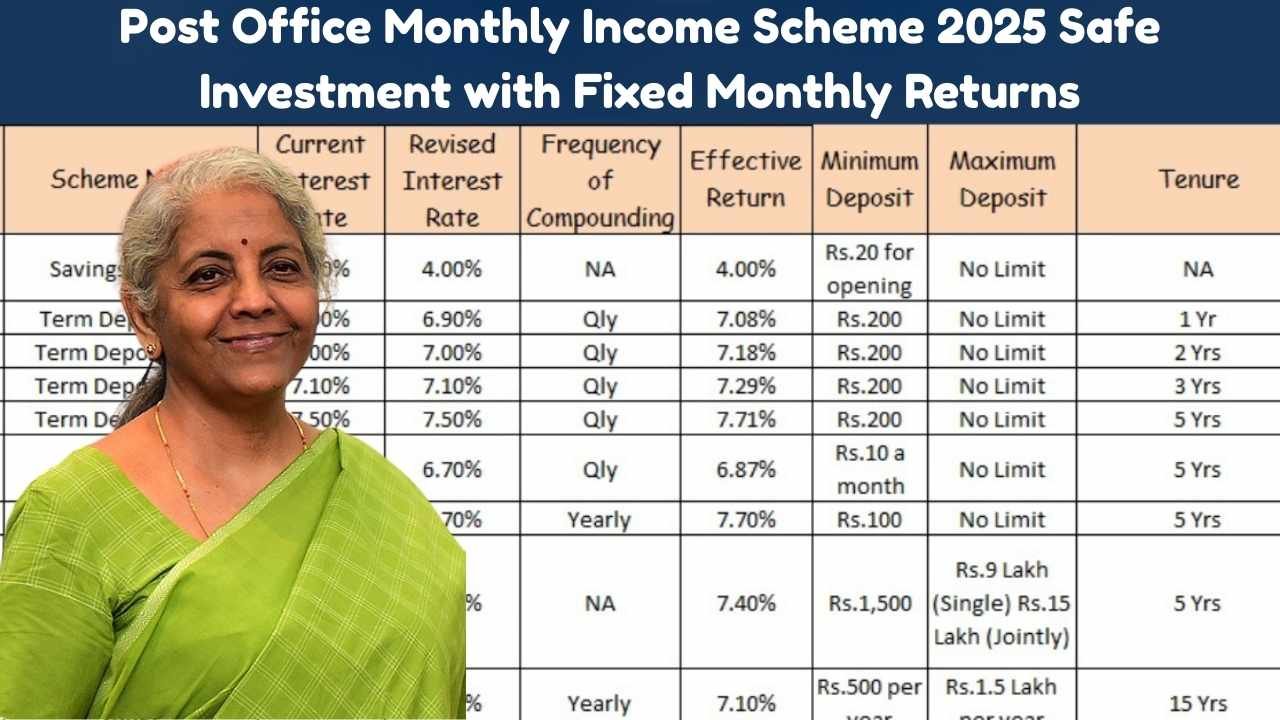

The Post Office MIS continues to provide features that make it appealing for small and medium investors. The minimum deposit required is Rs. 1,000, and investments can be made in multiples of 100. The maximum investment allowed in a single account is Rs. 9 lakh, while for joint accounts, the limit goes up to Rs. 15 lakh. The tenure of the scheme is five years, after which the investor can either withdraw the amount or reinvest it. The interest rate is decided by the government and is revised every quarter. This ensures that the scheme remains competitive with other fixed-income products.

Who Should Consider MIS?

The Monthly Income Scheme is suitable for a wide range of individuals. Retired people often choose it to ensure a regular flow of income after leaving their jobs. Homemakers and senior citizens also prefer it as it provides stability without any risk. Parents who want to create a safe income plan for household expenses find this scheme useful as well. Even conservative investors who do not want to risk their money in equities or mutual funds consider MIS as a safe option.

Benefits of MIS in 2025

The most important benefit of MIS is the fixed monthly return. Unlike market-linked instruments where returns are unpredictable, this scheme assures a steady payout every month. The government guarantee ensures that the invested capital is completely safe. Another advantage is the joint account facility, where two or three people can invest together, making it useful for families. The nomination facility is also available, allowing investors to secure the future of their loved ones.

Liquidity and Premature Withdrawal

Although the Post Office MIS comes with a fixed tenure of five years, premature withdrawal is allowed under certain conditions. If the account is closed before one year, no interest is paid. Between one and three years, a penalty of two percent is charged on the deposit, and after three years, the penalty reduces to one percent. This provides some flexibility in case the investor needs funds in an emergency, while still encouraging long-term saving discipline.

How the Monthly Income is Paid

The monthly income is credited directly into the savings account of the investor at the post office. For those who want convenience, linking it to a bank account is also possible. The payout happens regularly, which helps investors manage their monthly household expenses without worrying about irregular income. This makes MIS a reliable option for pensioners and families who depend on fixed earnings.

Comparison with Other Schemes

When compared to bank fixed deposits or recurring deposits, the Post Office MIS stands out for its guaranteed monthly payout feature. Bank FDs typically pay interest quarterly or at maturity, whereas MIS provides a steady flow every month. Unlike market investments such as mutual funds or shares, there is no risk of loss. While the returns may be lower compared to risky products, the security and stability of MIS make it an attractive option for conservative investors.

Taxation on MIS Returns

One important point to note is that the interest earned from the Post Office MIS is taxable. There is no deduction available under Section 80C for the amount invested, and the monthly interest is added to the investor’s total income. Depending on the tax slab, the investor will have to pay tax accordingly. However, for people in lower tax brackets, the scheme still provides an effective way to generate secure income.

MIS as a Retirement Planning Tool

For retirees, the MIS plays an important role in financial planning. Since pension from employers may not always be sufficient, having a steady monthly payout from the MIS ensures that day-to-day expenses are comfortably managed. The five-year maturity period aligns well with medium-term financial needs, and the option to reinvest after maturity helps in creating a continuous income cycle. Many retirees use MIS along with Senior Citizen Savings Scheme to build a diversified portfolio of safe government-backed products.

Why Choose Post Office for MIS?

The post office has a wide network across the country, making it easily accessible for people even in remote areas. For rural and semi-urban investors, this accessibility adds convenience. The trust and reliability of post office services also make people confident about investing their savings. With simple procedures and transparent rules, MIS through post office remains one of the most straightforward investment products available in India.

Conclusion

The Post Office Monthly Income Scheme in 2025 continues to be a safe and reliable option for individuals looking for fixed monthly returns. With its government backing, assured payouts, and simple process, it stands as an ideal investment for retirees, homemakers, and conservative investors. Though the interest is taxable, the stability and guaranteed income make it an unmatched choice for those who prioritize security over high returns. In a financial environment where market risks can be unpredictable, MIS shines as a dependable tool for financial peace of mind.

Disclaimer

This article is for informational purposes only and should not be taken as financial advice. Interest rates and rules are subject to change as per government notifications. Investors should check the latest updates with India Post or consult a financial advisor before making decisions.