Post Office Time Deposit is one of the most trusted investment options for Indian families seeking secure and reliable returns. Backed entirely by the Government of India, this scheme ensures that your money is safe while earning attractive interest over a fixed period. In 2025, Post Office Time Deposit continues to be a preferred choice for individuals who want guaranteed growth without the risks associated with market-linked investments.

Why choose Post Office Time Deposit in 2025

The main advantage of investing in a Post Office Time Deposit is security. Unlike stocks or mutual funds, the capital invested in this scheme is fully protected by the government. Additionally, the interest earned is assured, meaning investors know exactly how much they will receive at the end of the deposit period. The scheme is suitable for both small savers and those looking to invest large amounts, offering flexibility in tenure and ease of access through thousands of Post Office branches across India.

Tenure options and interest rates

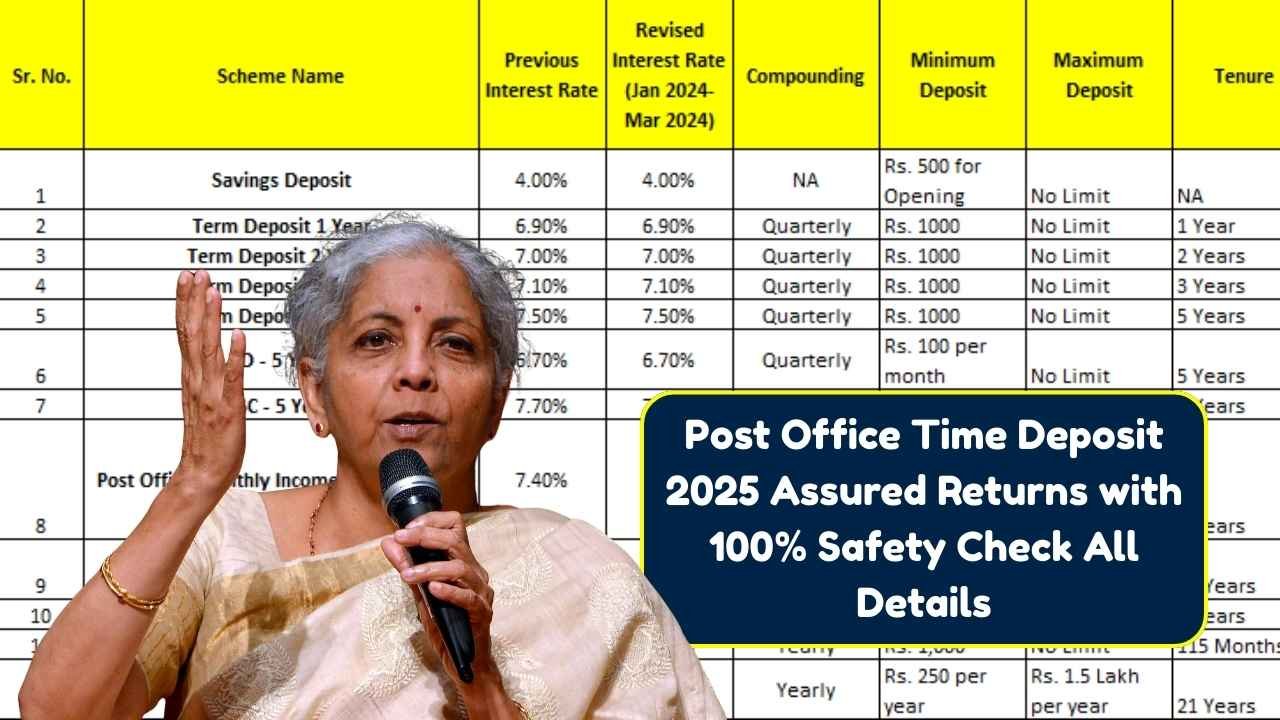

Post Office Time Deposit allows investors to choose from multiple tenure options, ranging from one year to five years. Each tenure comes with its own interest rate, which is reviewed and revised by the government periodically. Short-term deposits provide flexibility for those who need their money sooner, while long-term deposits offer higher interest rates, helping investors maximize their returns. The interest is compounded quarterly, ensuring that your savings grow steadily over time.

How to invest in Post Office Time Deposit

Investing in a Post Office Time Deposit is simple and accessible. You can visit your nearest Post Office branch and submit the required documents along with the deposit amount. Some branches also offer online investment facilities, making it convenient for tech-savvy users. The minimum deposit amount is quite affordable, allowing even beginners to start saving without financial strain. Once the deposit is made, investors receive a certificate confirming the deposit details and tenure.

Types of Post Office Time Deposits

In 2025, there are multiple options under the Post Office Time Deposit scheme to suit different investor needs. Regular Time Deposit allows a one-time deposit for a fixed tenure. Senior Citizen Time Deposit offers higher interest rates for individuals above the age of 60. There is also a recurring deposit variant where investors can deposit small amounts monthly, but with the same security and assured returns. These options provide flexibility for both short-term and long-term financial planning.

Advantages of Post Office Time Deposit

Post Office Time Deposit offers several advantages that make it a preferred investment choice. Firstly, it is backed by the government, ensuring 100% safety of the principal amount. Secondly, the interest rates are competitive, often higher than regular savings accounts. Thirdly, the scheme is flexible with various tenures, allowing investors to align deposits with their financial goals. Additionally, for senior citizens, the scheme provides higher interest rates, offering a secure income source during retirement.

Tax benefits and considerations

While the principal amount invested in a Post Office Time Deposit does not qualify for tax deductions under Section 80C, the interest earned is taxable according to the investor’s income tax slab. However, many investors prefer the security and assured returns of this scheme over tax-saving instruments that come with higher risks. Proper planning can ensure that the returns from the deposit align with overall financial goals while maintaining safety.

Ideal investors for Post Office Time Deposit

The scheme is particularly suitable for conservative investors who prioritize capital safety over high returns. Retirees looking for a stable income, parents saving for their children’s education, and individuals planning short-term financial goals all benefit from this scheme. It is also a suitable option for first-time investors who want a simple and secure way to grow their savings without dealing with market volatility.

Accessibility and convenience

One of the key advantages of Post Office Time Deposit is its accessibility. With thousands of Post Office branches across urban and rural India, anyone can invest in the scheme without hassle. The documentation process is straightforward, and the investment can be started with a modest amount, making it inclusive for people from all income groups. This widespread availability has contributed to the popularity of the scheme for decades.

Conclusion

Post Office Time Deposit in 2025 continues to be a safe and reliable investment option for individuals seeking guaranteed returns. With government backing, multiple tenure options, flexible deposit amounts, and competitive interest rates, it provides a perfect balance of security and growth. Whether you are a conservative investor, a retiree, or someone planning short-term financial goals, this scheme ensures your money is safe while earning predictable returns. For anyone looking for peace of mind and a secure way to grow savings, the Post Office Time Deposit remains a trusted choice.

Disclaimer

The information provided in this article about the Post Office Time Deposit 2025 scheme is based on official sources and publicly available details at the time of writing. Interest rates, tenure, and terms may change according to government policies. Readers are advised to verify the latest information with their local Post Office or the official Post Office website before making any investment decisions.