The Post Office Monthly Income Scheme (MIS) is one of the most trusted and secure government-backed savings plans in India. It is designed for individuals looking for a steady and guaranteed monthly income. With the rise of market uncertainties, many investors prefer safe options, and the MIS provides a perfect solution for retirees, homemakers, and anyone seeking reliable returns.

What is the Post Office Monthly Income Scheme?

The Monthly Income Scheme is a government initiative aimed at providing regular income to investors. Under this scheme, a fixed amount of deposit is made, and the investor receives a predetermined interest payout every month. The scheme is accessible to all Indian residents, including individuals, joint accounts, and trusts. One of the main attractions of MIS is the sense of security it offers, as it is backed by the Government of India.

Key Features of the Scheme

The scheme has several appealing features that make it a popular choice among investors. First, it provides guaranteed monthly income without exposing the investor to market risks. Second, the minimum deposit is quite affordable, allowing even small investors to benefit. Third, it is easily available at all post offices across India, making it accessible even in remote areas. The interest rate is revised periodically by the government, ensuring it remains competitive compared to other fixed-income options.

Eligibility and Deposit Limits

Any Indian resident can open an MIS account. Senior citizens can also take advantage of the scheme, often benefiting from higher returns. The minimum deposit required to open an account is ₹1,000, but for practical monthly income planning, a ₹5,000 deposit is often recommended. There is no maximum limit for deposits per individual, making it suitable for both small and large investors.

How the Monthly Income Works

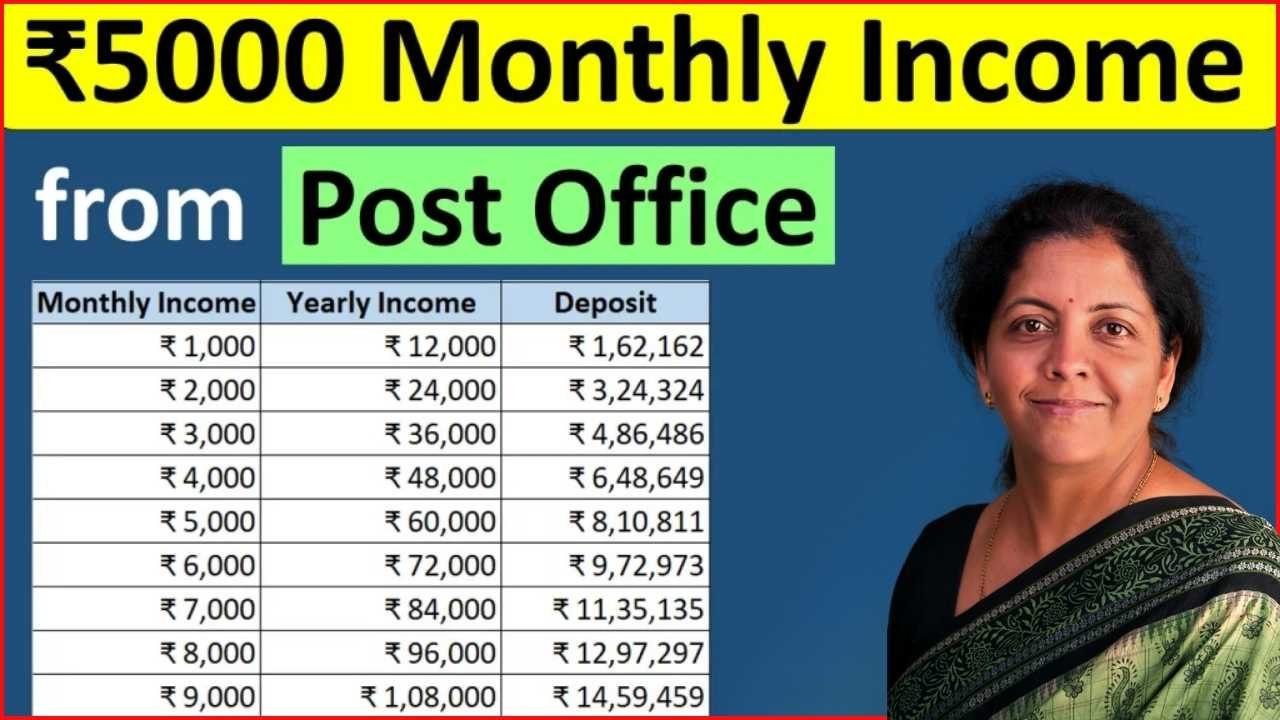

The Post Office MIS works on the principle of fixed monthly interest payouts. When an individual deposits ₹5,000, the government calculates the interest based on the prevailing rate. Currently, the interest rate for MIS is set to ensure consistent income. For example, a ₹5,000 deposit can generate a monthly interest of approximately ₹280 to ₹300, depending on the rate at the time. This interest is directly credited to the investor’s account, providing a reliable monthly cash flow.

Interest Rates and Payouts

The government revises the MIS interest rate quarterly. Historically, it has been higher than typical savings accounts, making it an attractive alternative. The interest earned is taxable, but the monthly payouts make it convenient for budgeting household expenses or planning regular expenditures. The scheme is particularly beneficial for retirees who require a predictable monthly income without taking financial risks.

Taxation on MIS

Interest earned from the Post Office MIS is taxable under the Income Tax Act. However, investors can plan their taxes efficiently by spreading deposits or combining MIS with other tax-saving instruments. Although the principal amount is not eligible for tax deduction, the safety and regular income offered make it worthwhile for risk-averse individuals.

Advantages of Investing in MIS

Investing in the MIS comes with several advantages. It ensures capital safety since the principal is fully guaranteed by the government. It provides a steady monthly income, which is ideal for those who do not have regular earnings. The scheme is simple to understand, requires minimal paperwork, and allows deposits in small amounts. Additionally, it fosters a habit of disciplined savings as individuals plan monthly deposits to secure steady income.

Ideal Candidates for MIS

The MIS is best suited for retirees, senior citizens, homemakers, and anyone seeking safe investment options with regular payouts. People who rely on fixed income, such as pensioners, can use MIS to supplement their earnings. Moreover, those who prefer low-risk investment over volatile stock markets or mutual funds find MIS an ideal choice.

How to Open an MIS Account

Opening an MIS account is straightforward. Investors can visit any post office in India, submit KYC documents, and fill out a simple application form. The deposit can be made in cash, cheque, or through transfer from an existing account. Once the account is opened, the investor receives monthly interest payouts either in cash or credited directly to their bank account. Online services at many post offices now make managing MIS accounts even more convenient.

Conclusion

The Post Office Monthly Income Scheme is a safe, reliable, and government-backed investment plan that provides consistent monthly income. With a ₹5,000 monthly deposit, investors can secure a stable source of cash flow, making it an ideal option for those looking for financial stability. Its accessibility, simplicity, and security make MIS one of the most trusted savings options in India. For anyone seeking a risk-free investment with regular income, the Post Office MIS is undoubtedly worth considering.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. Interest rates, terms, and benefits of the Post Office Monthly Income Scheme (MIS) are subject to change by the Government of India. Readers are advised to verify the latest rates, rules, and regulations with their local post office or official sources before making any investment decisions. The author or publisher is not responsible for any financial loss or consequences arising from the use of this information.