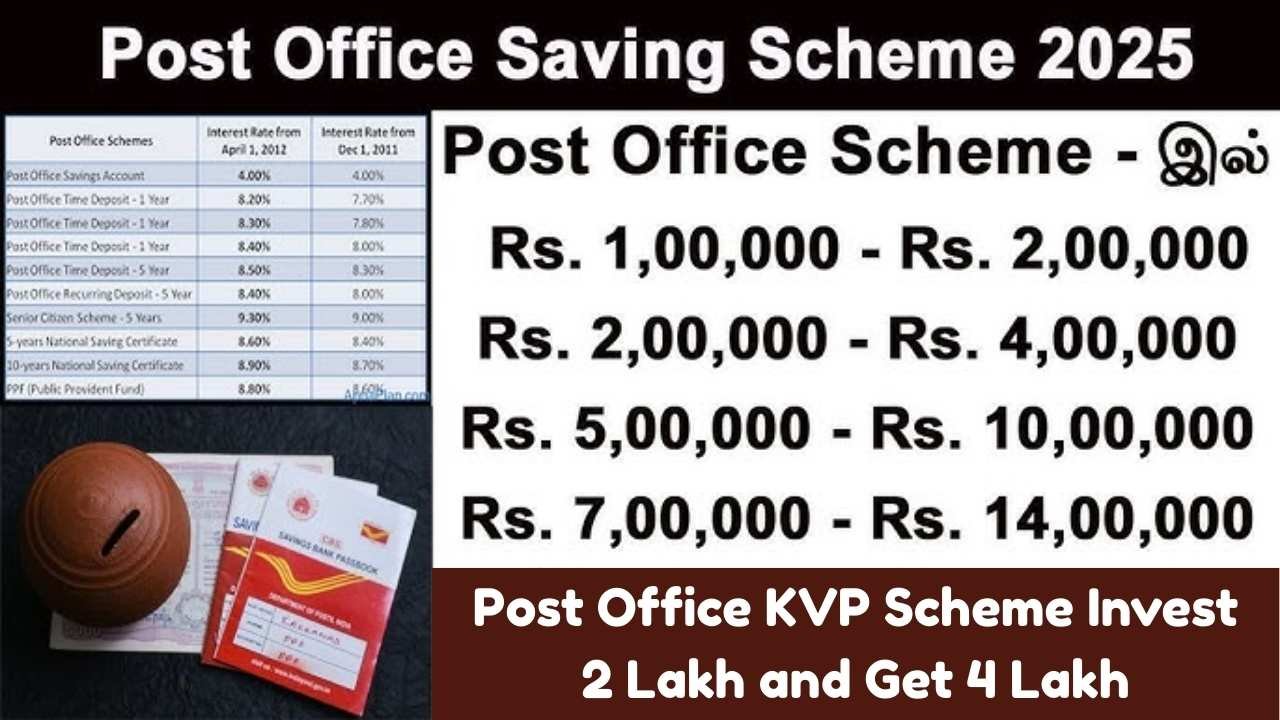

The Indian Post Office has been offering a wide range of savings schemes for decades, helping small investors secure their future with guaranteed returns. One such popular option is the Kisan Vikas Patra (KVP). Known for its simplicity and assurance of doubling the invested amount over time, this scheme has been attracting investors who prefer safety over risk.

If you are wondering how an investment of 2 lakh can grow into 4 lakh through this scheme, then it is important to understand its features, maturity period, and overall benefits before you decide to invest.

What is the Kisan Vikas Patra Scheme

Kisan Vikas Patra is a fixed return savings scheme run by the Post Office under the Ministry of Finance. It was originally designed for farmers, but today it is open for all Indian citizens. The core idea of this scheme is simple: the money you invest will double after a fixed period, offering a secure way to grow your savings without being affected by stock market risks.

Unlike market-linked investments, KVP does not fluctuate with market ups and downs. The government guarantees the returns, making it an attractive option for conservative investors and those who want to plan for long-term financial goals.

Current Interest Rate on KVP

The interest rate on KVP is revised by the government every quarter, depending on the economic situation and small savings rate structure. As of the latest update, the scheme offers an interest rate of 7.5 percent per annum.

At this rate, the money invested in KVP doubles in 115 months, which is approximately 9 years and 7 months. This means if you deposit 2 lakh today, you will receive 4 lakh at maturity after the completion of this period.

Minimum and Maximum Investment

One of the highlights of the KVP scheme is its flexibility in terms of the amount you can invest. The minimum investment starts at just 1000 rupees, making it accessible to almost everyone. After that, you can invest in multiples of 100. There is no maximum limit on the amount you can put into the scheme, which is why it is suitable for both small and large investors.

Whether you want to start small or make a big commitment, the scheme allows you to decide the investment size as per your financial capacity and goals.

How to Purchase KVP Certificates

Investors can buy KVP certificates from any Post Office across India. The process is straightforward and transparent. You will need to submit an application form along with necessary KYC documents such as Aadhaar card, PAN card, or Voter ID for verification. Once the documents are verified and the payment is made, the Post Office issues the certificate either in physical or electronic form.

The certificate acts as proof of your investment and carries details such as the name of the investor, investment amount, date of purchase, and maturity value.

Who Can Invest in KVP

The scheme is open to all Indian citizens above the age of 18. Parents or guardians can also purchase KVP certificates on behalf of minors. Joint accounts are allowed, where two adults can invest together. However, Hindu Undivided Families (HUFs) and Non-Resident Indians (NRIs) are not eligible to invest in this scheme.

Premature Withdrawal Rules

Although the main attraction of KVP is long-term investment, it does allow premature withdrawals under certain conditions. Generally, the lock-in period is two and a half years. After that, investors can withdraw their money, though the final amount will be less than the maturity value.

Premature encashment is also allowed in cases of the investor’s death, court order, or forfeiture by a pledgee. This feature ensures that investors have some level of flexibility in case of emergencies.

Tax Implications of KVP

One important point to note is that KVP does not provide any tax benefit under Section 80C of the Income Tax Act. The interest earned is fully taxable and falls under the investor’s income slab. However, since the scheme guarantees safe and steady returns, many investors still prefer it despite the tax liability.

Benefits of Kisan Vikas Patra

KVP continues to be a preferred choice among middle-class families, senior citizens, and risk-averse investors. Some of its key advantages include:

- Assured doubling of money after the maturity period

- Backed by the Government of India, ensuring complete safety of investment

- Easy availability at all Post Offices across the country

- No maximum investment limit, making it suitable for both small and large deposits

- Option to transfer the certificate from one Post Office to another or from one person to another

These benefits make KVP not just a savings option, but a tool to achieve financial security with minimal risk.

Example of Returns on 2 Lakh Investment

To better understand how the scheme works, let us consider a simple example. Suppose you invest 2 lakh rupees in KVP at the current interest rate of 7.5 percent. After 115 months, or 9 years and 7 months, this amount will double to 4 lakh.

This predictable growth makes it easier for investors to plan for future expenses such as children’s education, marriage, or retirement needs without worrying about market volatility.

Conclusion

The Post Office Kisan Vikas Patra scheme is a safe and reliable investment avenue for individuals who prioritize security over high but uncertain returns. By investing 2 lakh today, you can be sure of receiving 4 lakh at maturity in about 9 years and 7 months.

Although it does not offer tax benefits, the guaranteed doubling of money, government backing, and easy access make it a solid choice for long-term savings. For those looking to grow their wealth without taking risks, KVP is a scheme worth considering.

FAQs

1. How long does it take for money to double in the KVP scheme

It currently takes 115 months, or around 9 years and 7 months, for the invested amount to double.

2. What is the minimum amount required to invest in KVP

The minimum investment starts at 1000 rupees, and you can invest in multiples of 100 thereafter.

3. Is there any maximum limit for KVP investment

No, there is no upper cap. You can invest any amount depending on your financial capacity.

4. Can KVP be encashed before maturity

Yes, but only after two and a half years, except in cases such as the investor’s death, a court order, or forfeiture.

5. Does KVP offer tax benefits

No, KVP does not provide tax deductions under Section 80C. The interest earned is taxable.